SCHEDULE 14A (RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

x | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under § 240.14a-12 |

NORTHWEST NATURAL GAS COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

220 N.W. SECOND AVENUE

PORTLAND, OR 97209

April 17, 200614, 2008

To the Shareholders of Northwest Natural Gas Company:

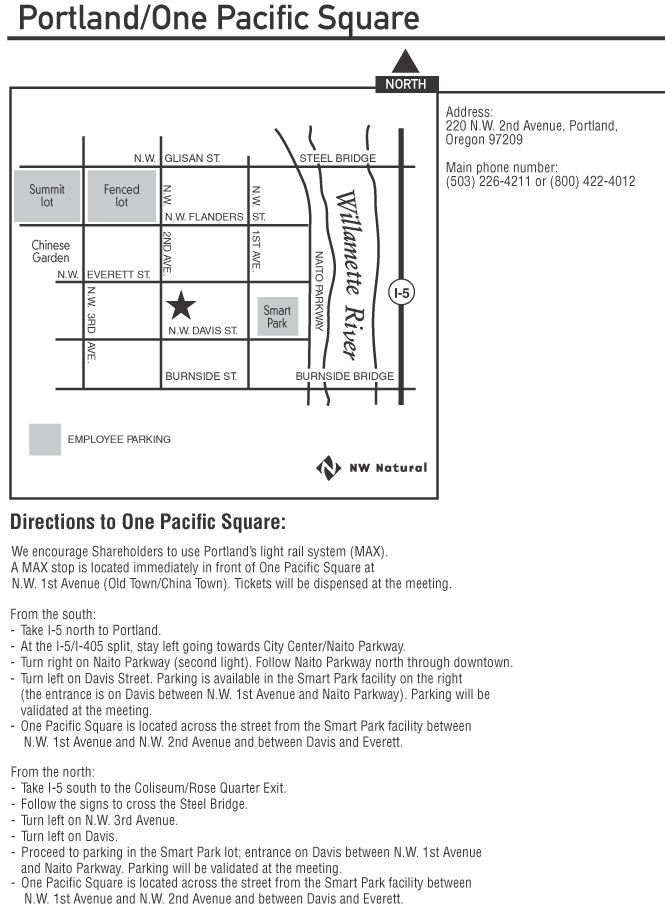

We cordially invite you to attend the 20062008 Annual Meeting of Shareholders of Northwest Natural Gas Company (the Company)(NW Natural), which will be held in the Colonel Lindbergh RoomHospitality Suite on the Fourth Floor of the Embassy Suites Hotel, 319 SW Pine Street,NW Natural’s offices, 220 N.W. Second Avenue, Portland, Oregon, on Thursday, May 25, 2006,22, 2008, commencing at 2:00 p.m., Pacific Daylight Time. We look forward to greeting as many of our shareholders as are able to join us.

At the meeting you will be asked to consider and vote upon: (1) the election of fourthree Class IIII directors for terms of three years, one Class I director for a term of one year and one Class II director for a term of two years; (2) the reapprovalamendment of the Company’s Long-Term Incentive Plan,NW Natural’s Employee Stock Purchase Plan; (3) the amendment of the Company’s Employee Stock Purchase Plan, (4) the restatementArticle III of the Company’sNW Natural’s Restated Articles of Incorporation, (5) the amendment of Article IV of the Restated Articles of IncorporationIncorporation; and (6)(4) the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’sNW Natural’s independent auditorsregistered public accountants for the year 2006.2008. Your Board of Directors unanimously recommends that you voteFOR each of Proposals 1, 2, 3 4, 5 and 6.4.

In connection with the meeting, we enclose a notice of the meeting, a proxy statement and a proxy card. Detailed information relating to the Company’sNW Natural’s activities and operating performance is contained in our 20052007 Annual Report, which is also enclosed.

It is important that your shares are represented and voted at the meeting. Whether or not you plan to attend, please vote your shares in one of three ways: via Internet, telephone or mail. Instructions regarding Internet and telephone voting are included on the proxy card. If you elect to vote by mail, please sign, date and return the proxy card in the enclosed postage-paid envelope. Your proxy may be revoked at any time before it is exercised in the manner set forth in the proxy statement.

Sincerely, | ||

Richard |

Mark S. Dodson | |

Chairman of the Board |

| |

NORTHWEST NATURAL GAS COMPANY

ONE PACIFIC SQUARE

220 N.W. SECOND AVENUE

PORTLAND, OREGON 97209

(503) 226-4211

NOTICE OF 20062008 ANNUAL MEETING OF SHAREHOLDERS

Portland, Oregon, April 17, 200614, 2008

To theour Shareholders:

The 20062008 Annual Meeting of Shareholders of Northwest Natural Gas Company (NW Natural) will be held in the Colonel Lindbergh RoomHospitality Suite on the Fourth Floor of the Embassy Suites Hotel, 319 SW Pine Street,NW Natural’s offices, 220 N.W. Second Avenue, Portland, Oregon, on Thursday, May 25, 2006,22, 2008, at 2:00 p.m., Pacific Daylight Time, for the following purposes:

| 1. | to elect |

| 2. | to |

| 3. | to amend |

| to ratify the appointment of PricewaterhouseCoopers LLP as |

| to transact such other business as may properly come before the meeting or any adjournment thereof. |

Holders of record at the close of business on April 6, 20063, 2008 are entitled to vote upon all matters properly submitted to shareholder vote at the meeting.

TheOur Board of Directors of the Company is soliciting the proxies of all holders of theNW Natural Common Stock who may be unable to attend the meeting in person. These proxies also will instruct the relevant fiduciary under the Company’sNW Natural’s Dividend Reinvestment and Direct Stock Purchase Plan or Retirement K Savings Plan to vote any shares held for shareholders’ benefit under those Plans,plans, as indicated on the proxies. A proxy and a stamped return envelope are enclosed for your use. No postage is needed if mailed in the United States. Instructions regarding Internet and telephone voting also are included on the enclosed proxy card.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 22, 2008

This proxy statement and our 2007 Annual Report are available on our website atwww.nwnatural.com.

Your vote is very important to us.

We urge you to vote by promptly marking, signing, dating and returning the enclosed proxy card, or by granting a proxy by telephone or the Internet in accordance with the instructions on the enclosed proxy card, as soon as possible. Your prompt vote will save the Companyus the additional expense of further requests to ensure the presence of a quorum. You may vote in person at the meeting whether or not you previously have returned your proxy.

By Order of the Board of Directors, |

/s/ Richelle T. Luther |

|

Corporate Secretary |

NORTHWEST NATURAL GAS COMPANY

April 17, 200614, 2008

Table of Contents

ONE PACIFIC SQUARE

220 N.W. SECOND AVENUE

PORTLAND, OREGON 97209

(503) 226-4211

20062008 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 25, 200622, 2008

PROXY STATEMENT

The Board of Directors of Northwest Natural Gas Company (NW Natural) is soliciting the proxies of all holders of theNW Natural Common Stock who may be unable to attend in person the Annual Meeting of Shareholders to be held in the Colonel Lindbergh RoomHospitality Suite on the Fourth Floor of the Embassy Suites Hotel, 319 SW Pine Street,our offices, 220 N.W. Second Avenue, Portland, Oregon, on Thursday, May 25, 2006,22, 2008, at 2:00 p.m., Pacific Daylight Time. The Company requestsWe request that you sign and return the enclosed proxy promptly. Alternatively, you may grant your proxy by telephone or the Internet.

The Company’sNW Natural’s Annual Report for the fiscal year ended December 31, 2005,2007, including audited financial statements, is being mailed to all shareholders, together with this proxy statement and the accompanying proxy card, commencing April 17, 2006.14, 2008.

The close of business on April 6, 20063, 2008 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the meeting.

VOTING BY PROXY AND HOW TO REVOKE YOUR PROXY

You may vote your shares either in person or by duly authorized proxy. You may use the proxy card accompanying this proxy statement if you are unable to attend the meeting in person or you wish to have your shares voted by proxy even if you do attend the meeting. If you are a registered shareholder, you may vote by telephone, Internet or mail, or you may vote your shares in person at the meeting. To vote:

By telephone (do not return your proxy card)

| Ÿ | On a touch-tone telephone, call the toll-free number indicated on your proxy card. Telephone voting is available 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Daylight Time on May |

| Ÿ | Have your proxy card available when you call. |

| Ÿ | Follow the simple recorded instructions. You will be prompted to enter your 12-digit Control Number located on your proxy card. |

By Internet (do not return your proxy card)

| Ÿ | Go towww.proxyvote.com. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Daylight Time on May |

| Ÿ | Have your proxy card available. |

| Ÿ | Follow the simple instructions. You will be prompted to enter your 12-digit Control Number located on your proxy card. |

By mail

| Ÿ | Mark your choice on your proxy card. If you properly execute your proxy card but do not specify your choice, your shares will be voted “FOR” Proposals 1, 2, 3 |

| Ÿ | Date and sign your proxy card. |

| Ÿ | Mail your proxy card in the enclosed postage-paid envelope. If your envelope is misplaced, send your proxy card to Northwest Natural Gas Company, c/o |

You may revoke your proxy at any time before the proxy is exercisedexercised: (1) by delivering a written notice of revocation,revocation; (2) by filing with the corporate secretaryCorporate Secretary a subsequently dated, properly executed proxy,proxy; (3) by voting after the date of the proxy by telephone or Internet,the Internet; or (4) by attending the meeting and voting in person. Your attendance at the meeting, by itself, will not constitute a revocation of a proxy. You should address any written notices of proxy revocation to:

Northwest Natural Gas Company

220 NW Second AvenueAve.

Portland, OR 97209

Attention: Corporate Secretary

If your shares are held in nominee or street name by a bank or broker, you should follow the directions on the instruction form you receive from your bank or broker as to how to vote, change your vote, or revoke your proxy.

If an adjournment of the meeting occurs, it will have no effect on the ability of shareholders of record as of the record date to exercise their voting rights or to revoke any previously delivered proxies.

VOTING YOUR SECURITIES OF THE COMPANY

The 27,588,29626,411,248 shares of Common Stock outstanding on March 17, 20062008 were held by 9,0147,823 shareholders residing in 50 states, the District of Columbia and a number of foreign countries.

Each holder of Common Stock of record at the close of business on April 6, 20063, 2008 will be entitled to one vote for each share of Common Stock so held on all matters properly submitted at the meeting. Such holder will be entitled to cumulative voting for directors; that is, to cast as many votes for one candidate as shall equal the number of shares held of record multiplied by the number of directors to be elected, or to distribute such number of votes among any number of the candidates.

A majority of the shares of Common Stock outstanding at the close of business on April 6, 20063, 2008 must be represented at the meeting, in person or by proxy, to constitute a quorum for the transaction of business.

It is important that your shares be represented at the meeting. You are urged, regardless of the number of shares held, to sign and return your proxy. Alternatively, you may grant your proxy by telephone or the Internet as described above.

PROPOSAL 1 – 1—ELECTION OF DIRECTORS

The Company’sNW Natural’s Restated Articles of Incorporation provide that the Board of Directors be comprisedcomposed of not less than nine nor more than 13 directors, with the exact number of directors to be determined by the Board. The Board has fixed the number of directors at 11. 12.

Our Chairman of the Board, Mr. Richard G. Reiten, has announced his plans to retire from Board service at the end of his current term, which expires at the 2008 Annual Shareholders Meeting. Mr. Reiten will chair the 2008 Annual Shareholders Meeting. Mr. Reiten has been a director since 1996 and served as NW Natural’s President and Chief Executive Officer (CEO) from 1997 through 2002 and as President and Chief Operating Officer from 1995 to 1997. Mr. Reiten became Chairman of the Board in 2000. After his retirement as President and CEO of NW Natural in 2002, Mr. Reiten continued to serve as a director and, through February 2005, as non-employee Chairman. Mr. Reiten was reelected as Chairman of the Board in December 2006. The Board of Directors thanks Mr. Reiten for his extensive and valued service to NW Natural. The Board does not expect to fill the vacancy on the Board of Directors created by Mr. Reiten’s retirement.

The Restated Articles also provide that the Board of Directors be divided into three classes and that the number of directors in each class be as nearly equal in number as possible. Members of each class are elected to serve a three-year term with the terms of office of each class ending in successive years.

The term of Class IIII directors expires with this year’s Annual Meeting. Ms. Martha L. “Stormy” Byorum and Messrs. Timothy P. Boyle, Mark S. Dodson, RandallJohn D. Carter and C. Papé and Richard L. WoolworthScott Gibson are nominees for election to the Board as Class IIII directors to serve until the 20092011 Annual Meeting or until their successors have been duly qualified and elected. Each of these directors wasAll were elected by the shareholders at the 20032005 Annual Meeting. Mr. George J. Puentes and Ms. Jane L. Peverett were elected to the Board of Directors to fill vacancies on July 27, 2007. Mr. Puentes is nominated for election to the Board as a Class I director to serve until the 2009 Annual Meeting or until his successor has been duly elected and qualified and Ms. Peverett is nominated for election to the Board as a Class II director to serve until the 2010 Annual Meeting or until her successor has been duly elected and qualified. Both Mr. Puentes and Ms. Peverett were recommended to the Governance Committee by the Chairman of the Board. In case any of the nominees should become unavailable for election for any reason, the persons named in the proxy will have discretionary authority to vote for a substitute. Management knows of no reason why any of the nominees would be unable to serve if elected.

Vote Required

Under Oregon law, if a quorum of shareholders is present at the Annual Meeting, the fourfive nominees who receive the greatest number of votes cast at the meeting shall be elected directors. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting but are not counted and have no effect on the results of the vote for directors.

The Board of Directors recommends the election of the nominees listed below.

INFORMATION CONCERNING NOMINEES

AND CONTINUING DIRECTORS

NOMINEES FOR ELECTION TO BOARD OF DIRECTORS

Class I

(For a term ending in 2009)

|

|

Since 1989, Mr. Boyle has served as President and Chief Executive Officer of Columbia Sportswear Company, an active outdoor apparel and footwear company headquartered in Portland, Oregon. He began working with Columbia Sportswear Company in 1970. Mr. Boyle is a member of the Boards of Directors of Widmer Brothers Brewing, the University of Oregon Foundation and Oregon Trout and is a trustee of Reed College and a past member of the Young Presidents’ Organization. He earned a Bachelor of Science degree in Journalism from the University of Oregon.

|

|

Mr. Dodson became Chief Executive Officer of the Company on January 1, 2003, where he previously served as President, Chief Operating Officer and General Counsel since 2001. He joined the Company in 1997 as Senior Vice President of Public Affairs and General Counsel, following a 17-year career with the Portland law firm Ater Wynne Hewitt Dodson & Skerritt. Mr. Dodson serves on the executive committee of Associated Oregon Industries and is a member of the Board of Directors of Catalyst Paper Corporation and the Oregon Business Council. He also has worked on affordable housing issues as a board member and chairman of the Neighborhood Partnership Fund. Mr. Dodson is currently the Chair of the Portland Business Alliance and was formerly Chairman of the Oregon State Board of Higher Education. He currently serves as a Trustee of Linfield College and as a member of the Board of Directors of Waseda University USA, and recently headed the Oregon Governor’s Task Force on Scholarship and Student Aid. He earned an undergraduate degree from Harvard University and a law degree from Boalt College of Law at the University of California, Berkeley.

|

|

Since 1981, Mr. Papé has served as President, Chief Executive Officer and a director of The Papé Group, Inc., a holding company for Papé Machinery, Inc., Flightcraft, Inc., Papé Material Handling, Ditch Witch Northwest, Industrial Finance Co. and Papé Properties, Inc. He also is President, CEO and a director of Liberty Financial Group, a holding company for LibertyBank, and its subsidiary, Commercial Equipment Lease Corporation. He is an owner and director of Sanipac, Inc. and its subsidiary, Eco Sort LLC, and a partner in Papé Investment Company. Mr. Papé serves as a commissioner of the Oregon Department of Transportation and also serves as chair of the Oregon Business Council. He is a former director and past president of Mt. Bachelor, Inc. and a former trustee and past president of the University of Oregon Foundation. He earned a Bachelor of Science degree in Finance from the University of Oregon.

|

|

Mr. Woolworth became Chairman of the Board of the Company on March 1, 2005. From 1995 through 2003, Mr. Woolworth served as Chairman and CEO of The Regence Group, the largest affiliation of BlueCross and/or BlueShield companies in the western United States. He also served as Board Chairman of Regence BlueCross BlueShield of Oregon and Regence HMO Oregon. He also serves as a director of the Columbia Mutual Funds. He is past chair of the national BlueCross and BlueShield Association, the Portland Chamber of Commerce, the Oregon Business Council and United Way and has chaired fundraising drives for both United Way and the Juvenile Diabetes Foundation. Mr. Woolworth is a former certified public accountant and a graduate of Lewis and Clark College in Portland.

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Class II

(Term ending in 2007)

|

|

Mr. Hamachek served as Chairman and Chief Executive Officer of Penwest Pharmaceuticals Company from October 1997 to February 2005. Penwest, which was spun off from Penford Corporation in 1998, is engaged in the research, development and commercialization of novel drug delivery products and technologies. From 1985 until 1998, Mr. Hamachek served as President and Chief Executive Officer of Penford Corporation, a diversified producer of specialty paper, food starches and pharmaceutical ingredients. He is a director of The Seattle Times Company and The Blethen Corporation (the majority owner of The Seattle Times Company). Mr. Hamachek is also a trustee of the Aldrich Museum of Contemporary Art in Ridgefield, Connecticut. He is a graduate of Williams College and Harvard Business School.

|

|

Since 2002, Mr. Thrasher has served as Chairman and Chief Executive Officer of Compli Corporation, a software solution provider for management of compliance in employment practices and corporate governance. Prior to joining Compli, Mr. Thrasher served 19 years in executive positions with Fred Meyer, Inc., including serving as President and Chief Executive Officer from 1999 to 2001, Executive Vice President and Chief Administrative Officer from 1997 to 1999, and Senior Vice President and CFO for 10 years. Mr. Thrasher serves on the board of directors of Friends of the Children, the Oregon Mentoring Initiative, the Portland Art Museum, the Childrens Institute, the Oregon Business Council, the Leaders Roundtable and the Oregon Coast Aquarium. In 2001, he was appointed by the Oregon Governor as Chairperson of the Quality Education Commission, a position he held until early 2005, including four years as chair. He is also a co-chair of Portland State University’s capital endowment campaign. Mr. Thrasher earned a Bachelor of Science degree in Business Administration from Oregon State University.

|

|

Mr. Tromley became Chairman and Chief Executive Officer of Tromley Industrial Holdings, Inc. in 2005 after having served as President and CEO since the company’s formation in 1990. Tromley Industrial Holdings is involved in nonferrous metals alloying and distribution, the manufacture and sale of equipment for the foundry and steel industry, industrial equipment leasing and industrial and retail business property investments. Mr. Tromley is a past President of the Casting Industry Suppliers Association and of the Arlington Club, and is a non-lawyer arbitrator for, and a member of the House of Delegates of, the Oregon State Bar Association. He was a founding director of The Bank of the Northwest, and served on the advisory board of Pacific Northwest Bank of Oregon and as a director emeritus of the Evans Scholars Foundation and the Western Golf Association. Mr. Tromley is a member of the Board of Directors of the Harvard Business School Alumni Association. Mr. Tromley attended the University of Washington and Harvard Business School.

Class III

(TermFor a term ending in 2008)2011)

| Martha L. “Stormy” Byorum Senior Managing Director, Stephens Cori Capital Advisors, New York, New York Age: Director since: 2004 Board |

In January 2005, Ms. Byorum became Senior Managing Director of Stephens Cori Capital Advisors, a division of Stephens, Inc., a private investment banking firm founded in 1933. From 2003 to 2004, Ms. Byorum served as Chief Executive Officer of Cori Investment Advisors, LLC, which was spun off from Violy, Byorum & Partners (VB&P) in 2003. VB&P was the leading independent strategic advisory and investment banking firm specializing in Latin America. Prior to co-founding VB&P in 1996, Ms. Byorum had a 24-year career at Citibank, where, among other things, she served as Chief of Staff and Chief Financial Officer for Citibank’s Latin American Banking Group from 1986-1990, overseeing $15 billion of loans and coordinating activities in 22 countries. She later was appointed the head of Citibank’s U.S. Corporate Banking Business and a member of the bank’s Operating Committee and Customer Group with global responsibilities. A graduate of Southern Methodist University and the Wharton School at the University of Pennsylvania, she is a Life Trustee of Amherst College, a Trustee Emeritus of the Folger Shakespeare Library and a board member of Aeterna-Zentaris Laboratories, Inc., a biopharmaceutical company.

| John D. Carter President and Chief Executive Officer, Schnitzer Steel Industries, Inc., Portland, Oregon Age: Director since: 2002 Board Committees: Audit (Chair), Finance, Governance |

Mr. Carter has served as President and Chief Executive Officer of Schnitzer Steel Industries Inc. since May 2005. From 2002 to May 2005, Mr. Carter was engaged in a consulting practice focused primarily on strategic planning in transportation and energy for national and international businesses, as well as other small business ventures. From 1982 to 2002, Mr. Carter served in a variety of senior management capacities at Bechtel Group, Inc., including Executive Vice President and Director, as well as President of Bechtel Enterprises, Inc., a wholly owned subsidiary of Bechtel Group, Inc., and other operating groups. Prior to his Bechtel tenure, Mr. Carter was a partner in a San Francisco law firm. He is a director of Schnitzer Steel Industries, FLIR Systems, Inc., and Kuni Automotive in the U.S. In the United Kingdom, he served as a director of London & Continental Railways until February 2006, and, until December 2005, served as a director of Cross London Rail Links, Ltd. He is a graduate of Stanford University and Harvard Law School.

| C. Scott Gibson President, Gibson Enterprises, Portland, Oregon Age: Director since: 2002 Board Committees: Public Affairs and Environmental Policy (Chair), Organization and Executive Compensation, Strategic Planning |

Mr. Gibson has been President of Gibson Enterprises, a venture capital firm, since its formation in 1992. In 1983, Mr. Gibson co-founded Sequent Computer Systems and served as its President from 1988 until March 1992. Before his tenure at Sequent, Mr. Gibson served as General Manager for the Memory Components Division of Intel Corporation. Mr. Gibson serves as Chairman of the Board of Radisys Corporation and as a director of TriQuint Semiconductor, Pixelworks, and Electroglas, Inc. and Verigy Pte. He also serves as a member of the Board of Trustees of the Oregon Community Foundation, the OHSU Foundation and the Franklin W. Olin College of Engineering, and is Vice Chair of the Oregon Health and Science University governing board. Mr. Gibson earned a Bachelor of Science degree in electrical engineering and a Masters in Business degree from the University of Illinois.

Class I

(For a term ending in 2009)

|

Age: Director since: Board Committees: Public Affairs and Environmental Policy, Finance |

Mr. Puentes serves as President of Don Pancho Authentic Mexican Foods, Inc., a manufacturer of tortillas and other foods, which he founded in Salem, Oregon in 1979. Mr. Puentes serves on the board of directors of the Federal Reserve Bank of San Francisco, Portland branch. He also serves as a trustee of the Meyer Memorial Trust and on the community Board for Regence Blue Cross Blue Shield. Mr. Puentes earned a Bachelor of Science degree in business management from San Jose State University.

Class II

(For a term ending in 2010)

| Jane L. Peverett President and Chief Executive Officer, British Columbia Transmission Corporation, Vancouver, British Columbia, Canada Age: 49 Director since: 2007 Board Committees: Audit, Strategic Planning |

Mr. Reiten served as Chief Executive Officer of the Company from January 1, 1997 until December 31, 2002. He joined the Company as President and Chief Operating Officer and was elected to the Board effective March 1, 1996. He was appointed to the additional position of Chairman of the Board in September 2000, a position he held until February 28, 2005. Prior to joining the Company, from 1992 through 1995, Mr. ReitenSince 2005, Ms. Peverett has served as President and Chief OperatingExecutive Officer of Portland General Electric Company (PGE) afterBritish Columbia Transmission Corporation (BCTC), an electric utility in Vancouver, British Columbia. Between 2003 and 2005, she served as Chief Financial Officer of BCTC. Prior to joining BCTC, from 1988 through 2003, Ms. Peverett held various senior positions with Union Gas Limited of Toronto, Ontario, including serving as its President and Chief Executive Officer between 2001 and 2003. Ms. Peverett serves on the board of PGE’s parentdirectors of EnCana Corporation, the B.C. Business Council and the Canadian Electricity Association. Ms. Peverett earned a Bachelor of Commerce degree from McMaster University and a Master of Business Administration degree from Queen’s University. She is a certified management accountant.

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Class I

(Term ending in 2009)

| Timothy P. Boyle President and Chief Executive Officer, Columbia Sportswear Company, Portland, Oregon Age: 58 Director since: 2003 Board Committees: Finance, Organization and Executive Compensation, Strategic Planning |

Since 1989, Mr. Boyle has served as President and Chief Executive Officer of Columbia Sportswear Company, an active outdoor apparel and footwear company headquartered in Portland, General Corporation (PGC), from 1989 through 1992.Oregon. He began working with Columbia Sportswear Company in 1970. Mr. Boyle is a member of the boards of directors of Columbia Sportswear Company, Widmer Brothers Brewing and Oregon Trout and is a trustee of Reed College, the Youth Outdoor Legacy Fund and a past member of the Young Presidents’ Organization. He also served as a director of PGC from 1983 to 1987 and from 1990 to 1995 when he retired from PGE. He is a director of U.S. Bancorp, Building Materials Holding Corporation, The Regence Group, Idacorp and National Fuel Gas Company. He is a past trustee of the University of Oregon Foundation and vice chairman of its capital campaign committee. He earned a Bachelor of Science degree in Journalism from the University of Oregon.

| Mark S. Dodson Chief Executive Officer, NW Natural, Portland, Oregon Age: 63 Director since: 2003 Board Committees: None |

Mr. Dodson became President and Chief Executive Officer of NW Natural on January 1, 2003, where he previously served as President, Chief Operating Officer and General Counsel since 2001. He relinquished the position of President in 2007. He joined NW Natural in 1997 as Senior Vice President of Public Affairs and General Counsel, following a 17-year career with the Portland law firm Ater Wynne Hewitt Dodson & Skerritt LLP. Mr. Dodson is currently on the board of directors of the American Gas Association and currentlythe Oregon Business Council and serves on the board of Associated Electricdirectors of Energy Insurance Mutual. He also has worked on affordable housing issues as a board member and Gas Insurance Services Ltd.,chairman of the Neighborhood Partnership Fund. Mr. Dodson was formerly the Chair of the Portland Business Alliance and the Oregon State Board of Higher Education. He currently serves as Vice Chairmana member of the board of directors of Waseda University USA, and headed the Oregon Governor’s Task Force on Scholarship and Student Aid. He earned an undergraduate degree from Harvard University and a law degree from Boalt College of Law at the University of California, Berkeley.

| Randall C. Papé President and Chief Executive Officer, The Papé Group, Inc., Eugene, Oregon Age: 57 Director since: 1996 Board Committees: Governance, Finance (Chair), Public Affairs and Environmental Policy |

Since 1981, Mr. Papé has served as President, Chief Executive Officer and a director of The Nature ConservancyPapé Group, Inc., a holding company for Papé Machinery, Inc., Flightcraft, Inc., Papé Material Handling, Ditch Witch Northwest, Papé Properties, Inc., Papé Trucks, Inc. and Papé Truck Leasing, Inc. He also is President, Chief Executive Officer and a director of Liberty Financial Group, a holding company for LibertyBank, and its subsidiary, Commercial Equipment Lease Corporation. He is an owner and director of Sanipac, Inc. and its subsidiary, Eco Sort LLC, and a partner in Papé Investment Company. Mr. Papé serves as a member and past chair of the Oregon Business Council. He is a former director and past president of Mt. Bachelor, Inc. and a trustee emeritus and past president of the University of Oregon Foundation. He earned a Bachelor of Science degree in Finance from the University of Oregon.

Class II

(Term ending in 2010)

| Tod R. Hamachek Former Chairman and Chief Executive Officer, Penwest Pharmaceuticals Company, Seattle, Washington Age: 62 Director since: 1986 Board Committees: Governance, Audit, Strategic Planning (Chair) |

Mr. Hamachek served as Chairman and Chief Executive Officer of Penwest Pharmaceuticals Company from October 1997 to February 2005. Penwest, which was spun off from Penford Corporation in 1998, is located in Danbury, Connecticut and is engaged in the research, development and commercialization of novel drug delivery products and technologies. From 1985 until 1998, Mr. Hamachek served as President and Chief Executive Officer of Penford Corporation, a diversified producer of specialty paper, food starches and pharmaceutical ingredients. He is a director of The Seattle Times Company and The Blethen Corporation (the majority owner of The Seattle Times Company). Mr. Hamachek is a member of the board of directors of Virginia Mason Medical Center and Virginia Mason Hospital System in Seattle, Washington. He is a graduate of Williams College and Harvard Business School.

| Kenneth Thrasher Chairman and Chief Executive Officer, Compli Corporation, Portland, Oregon Age: 58 Director since: 2005 Board Committees: Organization and Executive Compensation, Audit, Public Affairs and Environmental Policy |

Since 2002, Mr. Thrasher has served as Chairman and Chief Executive Officer of Compli Corporation, a software solution provider for management of compliance in employment practices and corporate governance. Prior to joining Compli, Mr. Thrasher served 19 years in executive positions with Fred Meyer, Inc., including serving as President and Chief Executive Officer from 1999 to 2001 and as Executive Vice President and Chief Administrative Officer from 1997 to 1999. In addition to serving on the NW Natural Board of Directors, Mr. Thrasher serves on the boards of directors of Compli Corporation, The Jensen Fund, Friends of the Children, Oregon Mentors, the Children’s Institute, the Portland State University Foundation, the Leaders Roundtable and the Oregon Coast Aquarium, and is a senior director on the Oregon Business Council. In 2001, he was appointed by the Oregon Governor as Chairperson of the Quality Education Commission, a position he held until his term expired in 2005. He also served as a co-chair of Portland State University’s capital endowment campaign through June 2005. Mr. Thrasher earned a Bachelor of Science degree in Business Administration from Oregon State University.

| Russell F. Tromley Chairman and Chief Executive Officer, Tromley Industrial Holdings, Inc., Tualatin, Oregon Age: 68 Director since: 1994 Board Committees: Audit, Governance, Organization and Executive Compensation (Chair) |

Mr. Tromley became Chairman and Chief Executive Officer of Tromley Industrial Holdings, Inc. in 2005 after having served as President and Chief Executive Officer since the company’s formation in 1990. Tromley Industrial Holdings is involved in nonferrous metals alloying and distribution, the manufacture and sale of equipment for the foundry and steel industry, industrial equipment leasing and industrial and retail business property investments. Mr. Tromley is a past President of the Casting Industry Suppliers Association and of the Arlington Club, and is a non-lawyer arbitrator for, and a member of the House of Delegates of, the Oregon State Bar Association. He was a founding director of The Bank of the Northwest, and served on the advisory board of Pacific Northwest Bank of Oregon and on the Boardas a director emeritus of the Oregon Community Foundation. He is a past General Chairman of the United Way campaign for Portland and a past Chairman of both the Portland Metropolitan Chamber of CommerceEvans Scholars Foundation and the Association for Portland Progress.Western Golf Association. Mr. Reiten is a graduate ofTromley attended the University of Washington and the Executive and Board of Directors Programs at StanfordHarvard Business School.

INFORMATION CONCERNING THECORPORATE GOVERNANCE

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Annual Meeting Attendance

The Board of Directors conducts its annual organization meeting on the same date as the Annual Meeting of Shareholders, which all of the directors are encouraged to attend. In 2005,2007, all of the Company’sour directors attended the Annual Meeting of Shareholders.

Independence

The Board of Directors has adopted Director Independence Standards to comply with updated New York Stock Exchange (NYSE) rules. The Director Independence Standards, amended as of December 16, 2004, are available on the Company’sour website atwww.nwnatural.com.www.nwnatural.comand are available in print to any shareholder who requests them. No director is deemed independent unless the Board affirmatively determines that the director has no material relationship with the CompanyNW Natural either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company.NW Natural. The Board applies its adopted standardsNW Natural’s Director Independence Standards as well as additional qualifications prescribed under the listing standards of the New York Stock ExchangeNYSE and applicable state and federal statutes. Annually the Board determines whether each director meets the criteria of independence. In 2006,2008, the Board determined that nineeleven of the eleventwelve directors met the independence criteria. They are directors Boyle, Byorum, Carter, Gibson, Hamachek, Papé, Peverett, Puentes, Reiten, Thrasher Tromley and Woolworth.Tromley. For a discussion of transactions considered by the Board in determining independence, see “Transactions with Related Persons,” below.

In determining that Mr. Reiten is deemed independent, in February 2007, the Board of Directors considered Mr. Reiten’s prior service as an executive officer of NW Natural. Mr. Reiten joined NW Natural as President and Chief Operating Officer in 1995 and was appointed President and Chief Executive Officer (CEO) in 1997 and Chairman of the Board in 2000. Mr. Reiten retired as President and CEO of NW Natural in 2002, continuing to serve as a director and, through February 2005, as non-employee Chairman. Mr. Reiten was again elected non-employee Chairman in December 2006, a position which he continues to hold. The Board also considered the compensation and benefits that Mr. Reiten has received since retiring and concluded that Mr. Reiten has received no compensation from NW Natural since his retirement as CEO, other than director and committee fees and pension and other forms of deferred compensation for prior services (which compensation was not contingent in any way on continued service). The Board considered the changes in the management team and company policies and initiatives that had occurred since Mr. Reiten’s retirement as CEO and Mr. Reiten’s activities in respect of NW Natural since his retirement and concluded that, since his retirement as CEO, Mr. Reiten had only acted as a director and, through February 2005 and from December 2006 to the present, only as non-employee Chairman. In reaching its determination that Mr. Reiten is independent, the Board considered these relevant facts and circumstances and affirmatively determined that Mr. Reiten has no material relationship with NW Natural, either directly or as a partner, shareholder or officer of an organization that has a relationship with NW Natural.

Other than with respect to Mr. Papé as described below under “Transactions with Related Persons,” for each other director who is deemed independent, there were no other significant transactions, relationships or arrangements that were considered by the Board in determining that the director is independent.

Board Nominations

The Board is responsible for selecting candidates for Board membership and the Governance Committee has been assigned the responsibility of recommending to the Board of

Directors nominees for election as directors. The Governance Committee has not used a third party to assist in finding candidates. The Governance Committee, with recommendations and input from the Chairman of the Board, the CEO and other directors, evaluates the qualifications of each director candidate in accordance with the Director Selection Criteria established by the Board. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of NW Natural, the existing and prospective business environment faced by NW Natural and the long-term interests of shareholders. In conducting its assessment, the Governance Committee considers a variety of criteria, including the following:

| Ÿ | Integrity. Directors should have proven integrity and be of the highest ethical character and share NW Natural’s values. |

| Ÿ | Reputation. Directors should have reputations, both personal and professional, consistent with NW Natural’s image and reputation. |

| Ÿ | Judgment. Directors should have the ability to exercise sound business judgment on a broad range of issues. |

| Ÿ | Knowledge. Directors should be financially literate and have a sound understanding of business strategy, business environment, corporate governance and Board operations. |

| Ÿ | Experience. Directors should be or have been in a generally recognized position of leadership in the nominee’s field of endeavor and have a proven track record of excellence in their field. |

| Ÿ | Maturity. Directors should value Board and team performance over individual performance, possess respect for others and facilitate superior Board performance. |

| Ÿ | Commitment. Directors should be able and willing to devote the required amount of time to NW Natural’s affairs, including preparing for and attending meetings of the Board and its committees, and should not be over-committed by service on multiple other boards. Directors should be actively involved in the Board and its decision-making. |

| Ÿ | Skills. Directors should be selected so that the Board has an appropriate mix of skills in core areas such as: accounting, finance, government relations, technology, management, compensation, crisis management, strategic planning and industry knowledge. |

| Ÿ | Diversity. Directors should be selected so that the Board of Directors is a diverse body. “Diversity” in this context includes considerations of geographic location, gender, race and professional background. |

| Ÿ | Age. In accordance with NW Natural’s Bylaws, the Board’s mandatory retirement age is 70. As such, directors must be able, and should be committed, to serve on the Board for an extended period of time. |

| Ÿ | Independence. Directors should neither have, nor appear to have, a conflict of interest that would impair the director’s ability to represent the interests of all NW Natural’s shareholders and to fulfill the responsibilities of a director. |

| Ÿ | Ownership stake. Directors should be committed to having a meaningful, long-term equity ownership stake in NW Natural and be willing to comply with our stock ownership guidelines. |

Shareholder Nominations

Shareholders’ recommendations for director-nominees may be submitted to NW Natural’s Corporate Secretary for consideration by the Governance Committee. In evaluating shareholder recommendations for director-nominees, the Governance Committee applies the same Director Selection Criteria discussed above. NW Natural’s Restated Articles of

Incorporation provide that no person, except those nominated by the Board, shall be eligible for election as a director at any annual or special meeting of shareholders unless a written request that his or her name be placed in nomination, together with the written consent of the nominee, shall be received from a shareholder of record entitled to vote at such election by the Corporate Secretary of NW Natural on or before the later of (a) the thirtieth day prior to the date fixed for the meeting, or (b) the tenth day after the mailing of the notice of that meeting.

Committees

There are six standing committees of the Board: the Audit, Governance, Organization and Executive Compensation, Finance, Public Affairs and Environmental Policy and Strategic Planning Committees.Planning. Each of the committees operates according to a formal written charter, all of which are reviewed annually and are available on the Company’sour website atwww.nwnatural.com. Copies of the charters are also available in print to any shareholder upon request. The performance of each committee is reviewed annually. Each committee may obtain advice and assistance from internal or external legal, accounting or other advisors, when appropriate.

Audit Committee

The Audit Committee is comprisedcomposed of directors Byorum, Carter, Hamachek, TromleyPeverett, Thrasher and Woolworth,Tromley, each of whom is an independent director as defined under current New York Stock ExchangeNYSE listing standards and the Company’sNW Natural’s Director Independence Standards. Ms. Peverett was appointed to the Audit Committee in July 2007. Based on its review of relevant information, the Board has determined that Mr. WoolworthCarter is an “audit committee financial expert” and “independent” as those terms are defined under applicable Securities and Exchange Commission (SEC) rules. Mr. Carter chairs the committee.

The Audit Committee is responsible for overseeing matters relating to accounting, financial reporting, internal control and auditing. The Audit Committee is also responsible for the appointment, compensation, oversight and review of the independent registered public accounting firm, and reviews the corporate audit and other internal accounting control matters with the independent auditor. A more detailed description of the Audit Committee’s responsibilities is included in the “Report of the Audit Committee,” which is included on page 33.below. The Audit Committee reports regularly to the Board. The Audit Committee held seven meetings during 2005. The Chair of the Committee,2007. Mr. Carter presides at all executive sessions of the Audit Committee.

Governance Committee

The Governance Committee is empowered, during intervals between Board meetings, to exercise all of the authority of the Board in the management of the Company,NW Natural, except as otherwise may be provided by law. The Committee,committee, which serves as the nominating

committee, makes recommendations to the Board regarding nominees for election to the Board, establishes criteria for Board and committee membership and policies that govern the Board’s activities, including the Corporate Governance Standards discussed below, and evaluates Board and individual director performance. It also considers any questions of possible conflicts of interest of Board members and senior executives and, jointly reviews annually the performance of the CEO with the Organization and Executive Compensation Committee.Committee, considers CEO succession plans. This Committeecommittee is comprisedcomposed of directors Carter, Hamachek, Papé, Tromley and Woolworth, each of whom is an independent director as defined under current New York Stock Exchange listing standards and the Company’s Director Independence Standards. The Committee held six meetings in 2005. The Chair of the Committee, Mr. Woolworth, presides at all executive sessions of the Committee and executive sessions of the non-management directors of the Board.

Organization and Executive Compensation Committee

The Organization and Executive Compensation Committee is comprised of directors Boyle, Gibson, ThrasherReiten and Tromley, each of whom is an independent director as defined under current New York Stock ExchangeNYSE listing standards and the Company’sNW Natural’s Director Independence Standards. Each member of this Committee also meetsThe committee held five meetings in 2007. Mr. Reiten chairs the criteria as a “non-employee director” under applicable rulescommittee. Mr. Reiten presides at all executive sessions of the SecuritiesGovernance Committee and Exchange Commission and the criteria for “outside directors” under Section 162(m)executive sessions of the Internal Revenue Code of 1986, as amended. Mr. Tromley chairs the Committee. The Committee reviews the performancenon-management directors of the CEO and other executive officers, considers executive compensation survey data in making recommendations to the Board relating to the Company’s executive compensation program and benefit plans, and administers the Restated Stock Option Plan, the Long-Term Incentive Plan, the Executive Deferred Compensation Plan, the Executive Annual Incentive Plan, the Directors Deferred Compensation Plan and the Deferred Compensation Plan for Directors and Executives. This Committee also makes recommendations to the Board regarding board compensation and organization and executive succession matters. Five meetings of this Committee were held during 2005.

The Report of the Organization and Executive Compensation Committee is included on page 26.Board.

Public Affairs and Environmental Policy Committee

The Public Affairs and Environmental Policy Committee reviews the Company’sNW Natural’s policies and practices relating to significant public and political issues that may have an impact on the Company’s our

business operations, financial performance or public image. It oversees the Company’sour programs and policies relating to civic, charitable and community affairs, safety and equal employment opportunity.opportunities. The Committeecommittee also develops and recommends to the Board appropriate environmental policies and advises the Board concerning the status of the Company’sNW Natural’s compliance with environmental regulations. The Committeecommittee makes recommendations to the Board to ensure that the Company fulfills itswe fulfill our objectives in a manner consistent with the responsibilities of good corporate citizenship. The Committeecommittee is comprisedcomposed of directors Gibson, Papé, Puentes, Reiten and Thrasher. Mr. Puentes was appointed to the committee in July 2007. Mr. Gibson serves as Chair of the Committee.committee. The Committeecommittee held three meetings in 2005.2007.

Finance Committee

The Finance Committee is responsible for reviewing strategies and making recommendations to the Board with respect to the Company’sour financing programs, financial policy matters and material regulatory issues. The Finance Committee consistsis composed of directors Boyle, Byorum, Carter, Papé, Puentes and Reiten. Mr. Papé chairs the Committee.committee. Mr. Puentes was appointed to the committee in July 2007. The Finance Committee held three meetings in 2005.

Strategic Planning Committee

The Strategic Planning Committee is responsible for reviewing and making recommendations to management and the Board of Directors with respect to theour long-term strategic goals, objectives and plans of the Company for the purpose of creating and maintaining long-term shareholder value. The Strategic Planning Committee is comprisedcomposed of directors Boyle, Gibson, Hamachek, Peverett and Reiten. Ms. Peverett was appointed to the committee in July 2007. Mr. Hamachek chairs the Committee,committee, which met three times in 2005.2007.

Board Nominations

The Board is responsible for selecting candidates for Board membership and the Governance Committee has been assigned the responsibility of recommending to the Board of Directors nominees for election as directors. The Governance Committee has not used a third party to assist in finding candidates. The Governance Committee, with recommendations and input from the Chairman of the Board, the Chief Executive Officer and other directors, evaluates the qualifications of each director candidate in accordance with the Director Selection Criteria established by the Board. The Director Selection Criteria includes three guiding principles: independence, absence of conflicts and diversity. Specific mandatory criteria include, among other things:

In addition, preferred criteria include, among other things, prior experience as a director of a public company, substantive knowledge of the utility industry and the ability to understand, analyze and apply financial information and accounting rules.

Shareholders’ recommendations for director-nominees may be submitted to the Secretary of the Company for consideration by the Governance Committee. In evaluating shareholder recommendations for director-nominees, the Governance Committee applies the same Director Selection Criteria discussed above. The Company’s Restated Articles of Incorporation provide that no person, except those nominated by the Board, shall be eligible for election as a director at any annual or special meeting of shareholders unless a written request that his or her name be placed in nomination, together with the written consent of the nominee, shall be received from a shareholder of record entitled to vote at such election by the Secretary of the Company on or before the later of (a) the thirtieth day prior to the date fixed for the meeting, or (b) the tenth day after the mailing of the notice of that meeting.

NON-EMPLOYEE DIRECTOR COMPENSATION

Fees and Arrangements

Following the Organization and Executive Compensation Committee’s reviewCommittee

The Organization and Executive Compensation Committee is composed of directors Boyle, Gibson, Thrasher and Tromley, each of whom is an independent director as defined under current NYSE listing standards and NW Natural’s Director Independence Standards. Each member of this committee also meets the criteria for a “non-employee director” under applicable SEC rules and the criteria for “outside directors” under Section 162(m) of the existing termsInternal Revenue Code of 1986, as amended (Internal Revenue Code). Mr. Tromley chairs the committee.

The committee reviews the performance of the CEO and other executive officers, considers executive compensation for non-employee directors and a review of a survey by the Committee’s independent consultant of compensation paiddata in making recommendations to non-employee directors of companies of comparable size, the Board of Directors approved modificationsrelating to our executive compensation programs and benefit plans, and oversees the terms of compensation to be paid to non-employee directors, effective January 1, 2005. The compensation terms for non-employee membersadministration of the Board of Directors are described below:

Annual Cash Retainer(New Board members and all after 12/31/08): | $ | 55,000 | |

Extra Annual Cash Retainer for Committee Chairs: | $ | 5,000 | |

Extra Annual Cash Retainer for Audit Committee Chair: | $ | 10,000 | |

Board Meeting Fees: | $ | 1,500 | |

Committee Meeting Fees: | $ | 1,000 | |

Extra Annual Cash Retainer for Chairman of the Board (effective March 1, 2005): | $ | 60,000 |

Assuming 14 meetings per year (7 Board and 7 Committee), for a Board member who chairs one Committee,Restated Stock Option Plan, the expected total annual compensation would be $77,500.

Effective January 1, 2005,Long-Term Incentive Plan, the Company increased its annual retainer for new directors from $35,000 to $55,000 and terminated the Company’s Non-Employee Directors StockExecutive Deferred Compensation Plan, with respect to new awards on January 1, 2005 (see below). All awards outstanding under the plan on January 1, 2005 will continue to vest according to the terms of the plan. Accordingly, current Board members who, as of the end of 2004, had unvested stock covered by outstanding awards, continue to vest with respect to such stock at approximately $20,000 worth of stock per year through December 31, 2008. During that time, their annual cash retainer would be $35,000 instead of $55,000.

Also effective January 1, 2005, the per diem fee for each day or significant portion of a day spent in the conduct of Company business on a day other than a day on which a meeting of the Board or a Board Committee is held was increased to $1,500.

During 2005, there were six meetings of the Company’s Board, each of which included an executive session of non-management directors. No continuing director attended fewer than 75 percent of the total meetings of the Company’s Board or Committees on which he or she served.

In 2002, the Board approved an arrangement for Mr. Reiten whereby he agreed to serve as non-employee Chairman of the Board through February 2005. According to the terms of the arrangement, Mr. Reiten was paid a monthly fee of $5,000 per month through February 2004 and, after that date, was paid a reduced monthly fee of $2,500 per month through February 2005. In addition, he was entitled to standard Board-approved cash and stock retainers and meeting fees, as well as office space, secretarial support and annual club dues. The Company continued to provide access to office space and secretarial support from March 1, 2005 until February 28, 2006, a benefit valued at approximately $104,000.

Non-Employee Directors Stock CompensationExecutive Annual Incentive Plan,

Before January 1, 2005, non-employee directors of the Company were awarded approximately $100,000 worth of the Company’s Common Stock upon joining the Board

pursuant to the Company’s Non-Employee Directors Stock Compensation Plan. These initial awards vested in monthly installments over the five calendar years following the award. On January 1 of each year following the initial year, non-employee directors were awarded an additional $20,000 of Common Stock, which vested in monthly installments in the fifth year following the award (after the previous award had fully vested). The shares awarded were purchased in the open market by the Company at the time of award. Non-employee directors could elect to receive awards in the form of deferred cash credits into the directors’ cash accounts under the Directors Deferred Compensation Plan, rather than in the form of Common Stock. Directors could elect also to defer unvested shares into their stock accounts under the Directors Deferred Compensation Plan. Any amounts deferred according to the Directors Deferred Compensation Plan would generally vest at the same time that the Common Stock would have vested.

All awards vest immediately upon the death of a director and upon a change in control of the Company. Unvested shares and unvested cash credits are forfeited if the recipient ceases to be a director. Certificates representing a director’s vested shares are not delivered to the director until after the director leaves the Board.

In September 2004, the Board of Directors amended the Non-Employee Directors Stock Compensation Plan to provide that no new awards will be granted on or after January 1, 2005. Previous awards will continue to vest in monthly installments according to the original vesting schedule.

Deferred Compensation Plans

Directors Deferred Compensation Plan

Prior to January 1, 2005, directors could elect to defer the receipt of all or a part of their directors’ fees under the Company’s Directors Deferred Compensation Plan (DDCP). At the director’s election, deferred amounts were credited to either a “cash account” or a Company “stock account.” If deferred amounts were credited to stock accounts, such accounts were credited with a number of shares based on the purchase price of the Common Stock on the next purchase date under the Company’s Dividend Reinvestment and Direct Stock Purchase Plan, and such accounts were credited with additional shares based on the deemed reinvestment of dividends. Cash accounts were credited quarterly with interest at a rate equal to Moody’s Average Corporate Bond Yield plus two percentage points. The crediting rate was subject to a six percent minimum rate. The rate was adjusted quarterly. At the election of the participant, deferred balances in the stock and/or cash accounts were payable after termination of Board service in a lump sum, in installments over a period not to exceed 10 years, or in a combination of lump sum and installments.

The Company’s obligations under the DDCP are unfunded and benefits will be paid either from the general funds of the Company or from the Umbrella Trust for Directors which has been established for the DDCP. With respect to the cash accounts, the Company has purchased life insurance policies on the lives of the participants, the proceeds from which will be used to reimburse the Company for the payment of cash benefits from the DDCP. The cost of any one individual participant cannot be properly allocated or determined because of overall Plan assumptions. In addition, the Company has contributed cash and Common Stock to the trustee of the Umbrella Trust such that the Umbrella Trust holds the number of shares of Common Stock equal to the number of shares credited to all directors’ stock accounts. Shares so held will be used to fund the Company’s obligation to pay out the stock accounts.

The Company may from time to time transfer other assets to the trustee of the Umbrella Trust to hold in trust for the benefit of DDCP participants. The Company’s obligations under

the DDCP are not limited to trust assets, and DDCP participants will have a claim against the Company for any payments not made by the trustee. The Company instructs the trustee as to the investment of the trust’s assets and the trustee’s fees and expenses are paid by the Company.

Upon the occurrence of certain events, such as a change in control of the Company, termination of the DDCP or the failure by the Company to provide the trust with adequate funds to pay current benefits, the Company may be required under the terms of the trust to contribute to the trust annually the amount by which the present value of all benefits payable under the DDCP exceeds the value of the trust’s assets.

In September 2004, the Board approved an amendment to the DDCP partially terminating the plan so that no deferrals will be made to the plan subsequent to December 31, 2004. All amounts deferred into the plan prior to December 31, 2004 will remain in the plan and all other provisions of the DDCP remain in effect.

2005 Deferred Compensation Plan for Directors and Executives and the Non-Employee Directors Stock Compensation Plan. This committee also makes recommendations to the Board regarding Board compensation and organization and executive succession matters. Six meetings of this committee were held during 2007.

Purpose of the Committee.The committee operates pursuant to a written charter that provides that the purposes of the committee are to:

In November 2004,

| Ÿ | discuss and review the management of the affairs of NW Natural relating to its organization and to executive personnel and their compensation; |

| Ÿ | produce an annual report on executive compensation for inclusion in NW Natural’s proxy statement; and |

| Ÿ | provide input and guidance to management in the preparation of the Compensation Discussion and Analysis also included in NW Natural’s proxy statement. |

The committee is responsible for discharging the responsibilities of the Board of Directors approved the Northwest Natural Gas Company Deferred Compensation Plan for Directors and Executives (DCP), effective January 1, 2005.

The DCP replaced the existing Executive Deferred Compensation Plan (EDCP) and the DDCP as the vehicle for nonqualified deferral of compensation by executives and directors. The DCP includes a number of technical changes from the EDCP and DDCP in provisions relating to the timingcompensation of deferral electionsexecutives by ensuring that the CEO and the timingother senior executives of payout elections as necessary to complyNW Natural are compensated appropriately and in a manner consistent with the deferredstated compensation strategy and the requirements of the American Jobs Creation Actappropriate regulatory authorities. The committee’s policies and decisions applicable to the compensation of 2004. However, the DCP continues the basic provisionsall of the EDCPNamed Executive Officers (defined below in the “Compensation Discussion and DDCPAnalysis” section) are generally similar in all material respects. The committee’s current charter is available on our website and may be accessed atwww.nwnatural.com.

Delegation of Authority. The Board of Directors has delegated to the committee its full authority to grant stock options under which deferred amounts are credited to either a “cash account” or a Company “stock account.” Stock accounts represent a right to receive shares of Company Common Stock on a deferred basis, and such accounts are credited with additional shares based on the deemed reinvestment of dividends. Cash accounts are credited quarterly with interest at a rate equal to Moody’s Average Corporate Bond Yield plus two percentage points. The crediting rate is subject to a six percent minimum rate. The Company’s obligation to pay deferred compensation in accordance with the terms of the DCP will generally become due on retirement, death, or other termination of service,Restated Stock Option Plan and will be paid in a lump sum or in installments of five or ten years as elected by the participant in accordance withto grant awards under the terms of the DCP. The rightLong-Term Incentive Plan. Both of each participant in the DCP is that of a general, unsecured creditorthese plans have been approved by our shareholders. With respect to other components of the Company.Named Executive Officers’ compensation, the committee submits its recommendations to the Board for approval. Day-to-day administration of certain director and executive plans has been delegated, under the terms of the plans, to certain officers, with oversight provided by the committee.

Directors Retirement Benefit

On January 1, 1998,Management’s Role. Management provides support to the committee in connection with the termination of a prior retirement benefit for directors and in lieu of that benefit, the Company credited a number of sharesways to facilitate executive compensation decisions, including working with outside counsel on plan design changes, preparing reports and materials, communicating with outside advisors, administering plans and implementing the committee’s decisions. The senior vice president responsible for human resources is the primary contact for the committee and the CEO makes recommendations to the committee regarding plan design, salary increases, incentive awards and other executive compensation decisions for executives other than himself.

Use of Company Common StockConsultants.The committee has engaged Towers Perrin, an independent compensation consulting firm (the consultant), to a stock accountassist in the evaluation of the competitiveness of our executive compensation programs and to provide overall guidance to the committee in the design and operation of these programs. The consultant reports directly to the committee chair and the chair approves all invoices submitted by the consultant. At the direction and under the DDCP for each then current director. If such a director retires from the Board at age 70 or older with 10 or more years of service as a director or if the director earlier dies or becomes disabled or if there is an earlier change in controlguidance of the Company,committee chair, the Company is obligatedconsultant works with management, principally the senior vice president responsible for human resources, in developing recommendations with respect to deliverexecutive compensation and executive programs for submission to the director (or to his or her beneficiary) the number of shares credited to the account, plus an additional number of shares based on reinvested dividends credited to the account over time. Concurrentlycommittee for its consideration.

Succession Planning.The committee periodically reviews with the creationCEO and the senior vice president responsible for human resources, NW Natural’s succession planning process. Our succession planning process includes the identification of potential internal and external candidates, the use of various assessment tools which have included multi-rated feedback and emotional intelligence and personality assessments. The plan is updated on a periodic basis.

The Report of the stock accounts, the Company contributed to the Umbrella Trust for Directors a number of shares of the Company’s Common Stock equal to the number of shares credited to directors’ accounts. Such stockOrganization and Executive Compensation Committee is held in the Umbrella Trust and will be used to fund the Company’s obligation to pay out the stock accounts. The number of shares of Common Stock in the retirement benefit stock account of each such director at December 31, 2005 was: Tod R. Hamachek, 858; Randall C. Papé, 647; Richard G. Reiten, 1,421; and Russell F. Tromley, 1,321.included on page 21.

CORPORATE GOVERNANCE STANDARDS

The Board of Directors adoptedmaintains Corporate Governance Standards that are intended to provide the CompanyNW Natural and its Board of Directors with guidelines designed to ensure that business is conducted to serve stakeholders with the highest level of integrity. These Corporate Governance Standards are reviewed annually by the Governance Committee to determine if changes should be recommended to the Board of Directors. The Corporate Governance Standards, as amended as of September 21, 2005,July 26, 2007, are available on the Company’sour website atwww.nwnatural.com and are available in print to any shareholder who requests a copy. Among other matters, the Corporate Governance Standards include the following:

| Ÿ | A substantial majority of the Board should be independent and the Board annually assesses the independence of each Board member in accordance with |

| Ÿ | The Governance Committee, the Audit Committee and the Organization and Executive Compensation Committee consist entirely of independent directors, as that term is defined by |

| Ÿ | Director nominees are recommended by the Governance Committee to the full Board in accordance with the |

| Ÿ | Directors must retire from the Board at the first annual meeting of shareholders after reaching age 70. |

| Ÿ | The Board and Committee structure and function, including expected Board meeting attendance and review of materials. |

| Ÿ | Board members have complete access to |

| Ÿ | The Governance Committee oversees the annual assessment of the performance and effectiveness of the Board, including Board |

| Ÿ | Annually the Board reviews and approves the strategic plan and one-year operating and capital expenditure |

| Ÿ | Committee members are recommended by the Governance Committee for appointment by the Board and |

| Ÿ | The Board provides for an executive session of non-management directors at the end of each Board meeting. The chair of the Governance Committee presides at these executive sessions. |

| Ÿ | Succession planning and management development are reported at least annually by the |

| Ÿ | The Organization and Executive Compensation |

| Ÿ | Within five years after joining the Board, each Board member shall own |

vested and unvested shares awarded under the Non-Employee Directors Stock Compensation Plan) valued at the lesser of $300,000 or five times the Board member’s annual retainer fee. |

| Ÿ | Stock ownership guidelines for executives. See “Compensation Discussion and Analysis—Stock Ownership Guidelines,” below. |

| Ÿ | Director orientation and continuing education programs are provided which are designed to familiarize new directors with the full scope of |

| Ÿ | Incentive compensation plans link pay directly and objectively to measured financial and other goals set in advance by the Board. |

| Ÿ | The Code of Ethics and Financial Code of Ethics policies, both of which are available on |

In addition, the Board of Directors has adopted procedures for the receipt, retention and treatment of concerns from Companyof our employees, shareholders, customers and othersother interested parties regarding accounting, financial reporting, internal controls, auditing or other matters. EmployeesConcerns may submit concerns anonymously pursuant to the Code of Ethics’ hotline, located on the Company’s internal Web site. Shareholders may submit concernsbe submitted in writing to the non-management directors of the Company,NW Natural, c/o the Corporate Secretary, 220 NWN.W. Second Avenue, Portland OR 97209, or by calling 1-800-541-9967 or sending an e-mail todirectors@nwnatural.com. Employees may also submit concerns anonymously pursuant to the Code of Ethics’ hotline, located on our internal website. Our Director of Internal Auditing handles matters reported on the internal hotline and provides a regular report to the Audit Committee on hotline activity.

Concerns relating to accounting, financial reporting, internal accounting controls or auditing matters will be referred by the Corporate Secretary to the chair of the Audit Committee and the chair of the Governance Committee. Other concerns will be referred by the Corporate Secretary to the chair of the Governance Committee. The Corporate Secretary provides a regular report to the Governance Committee on all contacts.

SECTION 16(A)16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’sNW Natural’s directors and executive officers to file reports of ownership and changes in ownership of CompanyNW Natural Common Stock with the Securities and Exchange Commission. The Company isSEC. We are required to disclose in this proxy statement any late or missed filings of those reports made by itsour directors and executive officers during 2005.2007. One report was filed late for Lea Anne Doolittle, our senior vice president, relating to the indirect beneficial ownership of a stock option grant made to her spouse, an employee of NW Natural, in 2007. Based solely upon a review of the copies of such reports furnished to itus and written representations that no other such reports were required, the Company believeswe believe that during 20052007 all other directors and executive officers timely filed all such required reports.

CERTAIN RELATIONSHIPSCOMPENSATION COMMITTEE INTERLOCKS AND RELATED TRANSACTIONSINSIDER PARTICIPATION

There are no “Compensation Committee interlocks” or “insider participation” which SEC regulations or NYSE listing standards require to be disclosed in this proxy statement.

TRANSACTIONS WITH RELATED PERSONS

The written charter of the Audit Committee designates responsibility for reviewing related person transactions with the Audit Committee. The Board has adopted a written policy on the review of related person transactions (which is available on our website atwww.nwnatural.com) that specifies that certain transactions involving directors, nominees, executive officers, significant shareholders and certain other related persons in which NW Natural is or will be a participant and are of the type required to be reported as a related person transaction under Item 404 of SEC Regulation S-K shall be reviewed by the Audit Committee for the purpose of determining whether such transactions are in the best interest of NW Natural. The policy also establishes a requirement for directors, nominees and executive officers to report transactions involving a related party that exceed $5,000 in value. We are not aware of any transactions entered into since the adoption of the policy in December 2006 that did not follow the procedures outlined in the policy.

The Papé Group

From time to time, the CompanyNW Natural conducts business with affiliates of The Papé Group, Inc., of which director Randall C. Papé is President, Chief Executive Officer and a major shareholder.

The CompanyIn May 2007, in accordance with the policy described above, NW Natural entered into a lease throughextension with Papé Properties Inc. for NW Natural’s Coos Bay resource center for a term ending May 31, 20072008. The original term of the lease expired May 31, 2007. The original base rent for the lease was $5,500 per month, with an affiliateescalations equal to the change in the Consumer Price Index beginning the 25th month of The Papé Group andthe term of the lease. NW Natural paid $78,167$73,194 in connection with the lease in 2005. 2007. The lease includes an option to purchase which may be exercised within 10 days after a 60-day notice period and upon payment of a refundable escrow deposit of 5 percent of the purchase price. NW Natural is currently considering whether to further extend the lease or exercise the option to purchase. The Board of Directors has pre-approved exercising the option, subject to obtaining market appraisals consistent with the terms of the proposed transaction.

From time to time, the Companywe also purchasespurchase equipment from and employsemploy the services of certain affiliates of The Papé Group. In 2005, the Company2007, we paid $271,159$150,591 for such equipment and services.services, none of which were subject to installment payments. Although we are not aware of Mr. Papé having a direct interest in these transactions, we have assumed that, as a major shareholder of The Papé Group, the dollar value of the amount of his interest in the transactions approximates the amount of NW Natural’s payments. Based upon representations from The Papé Group’s independent auditor and a review of the transactions, including independent determinations that the aggregate amount of the transactions represented less than one percent of The Papé Group’s consolidated revenue for 2007, the Board of Directors has affirmatively determined that these transactions were arm’s length transactions entered into in the ordinary course of business and not material. The Board considered these transactions in assessing Mr. Papé’s independence and determined that these transactions did not affect Mr. Papé’s designation as an independent director.

Fund Contribution in Recognition of Service of CEO, Mark Dodson

In December 2007, NW Natural contributed $150,000 to the Oregon Community Foundation to establish the NW Natural Mark S. Dodson Fund in honor of CEO and director, Mark S. Dodson. The fund is for general charitable purposes and Mr. Dodson and his family members will advise the Oregon Community Foundation on the fund’s use. Directors Reiten and Gibson are members of the Board of Trustees of the Oregon Community Foundation. The Board approved this transaction in September 2007. The Board considered this transaction in assessing Messrs. Reiten’s and Gibson’s independence and determined that it did not affect their designation as independent directors.

Employment of Spouse of a Named Executive Officer